Let’s talk about your move-out process and what happens once a tenant has left your property.

Initially, you’ll need to get inside the home to inspect it for any potential damage. This isn’t always as easy as it sounds. Often, it’s difficult to determine what looks like

damage in the property versus what should be considered normal wear and tear.

The definition of wear and tear is sometimes subjective, and that’s what throws rental property owners off when they’re trying to decide what they’re responsible for repairing after a lease is over and what they can charge to a departing tenant’s security deposit.

Wear and tear is your responsibility as an owner. How do you know what it is?

Identifying Normal Wear and Tear in a Vancouver Rental Property

Normal wear and tear is the natural deterioration that happens to a property whenever a person lives in that property. It’s the type of thing that will happen to any home, no matter who is there.

For the purposes of rental property, wear and tear usually will include:

-

Small nail holes in the wall from where a tenant might have hung pictures or mirrors or clocks. - Scuff marks on the walls or in the carpet from where furniture rested.

- Worn carpet in high-traffic areas.

- Paint that has faded due to sunlight or age.

- Appliances needing repairs and replacements because they’ve been used every day.

Landlords are responsible for these costs because they go with the expenses that you plan on when you buy an investment home. It’s your responsibility to maintain your home and keep it safe and habitable.

Make sure you’re budgeting for wear and tear items during turnover periods. You cannot charge the tenant’s security deposit for these issues that you are likely to find every time you’re preparing the home for a

new tenant.

What Wear and Tear IS NOT

Damage is different.

Even if a resident broke something unintentionally, it’s still that resident’s responsibility.

When you inspect the property and notice damage beyond the normal wear and tear or any problems that are due to the abuse, misuse, or neglect of your property, you can turn to the security deposit and use those funds to pay for repairs and replacements.

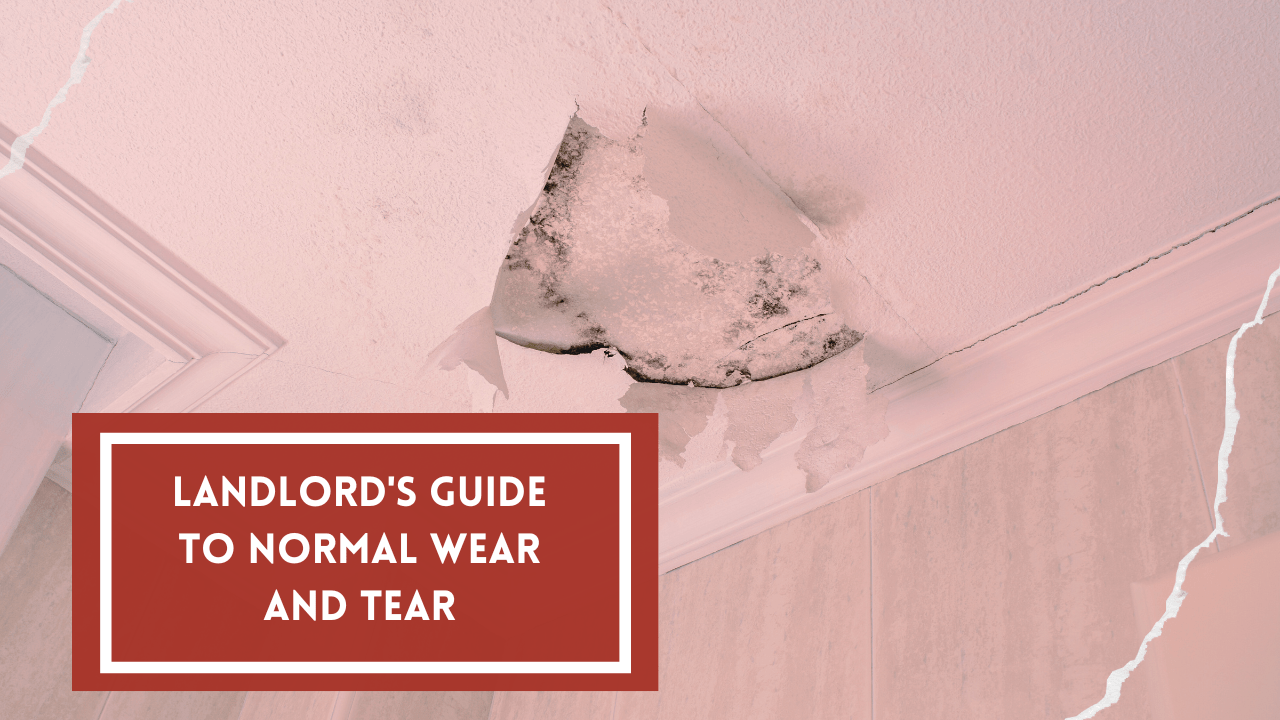

Large holes in the walls or broken windows would qualify as damage. Huge scratches on wood floors from a dog or mold under a sink because a leak was never reported could also be considered damage.

Documenting Rental Property Condition

Make sure you know what you’re looking at when you’re evaluating the move-out condition of your investment property. You don’t want to get into any tenant disputes, and you don’t want to be unfair.

If you’re not sure, rely on the experience of Vancouver property managers. We can help. Contact us at SunWorld Group during your move-out process, and we’ll help you identify and understand normal wear and tear.